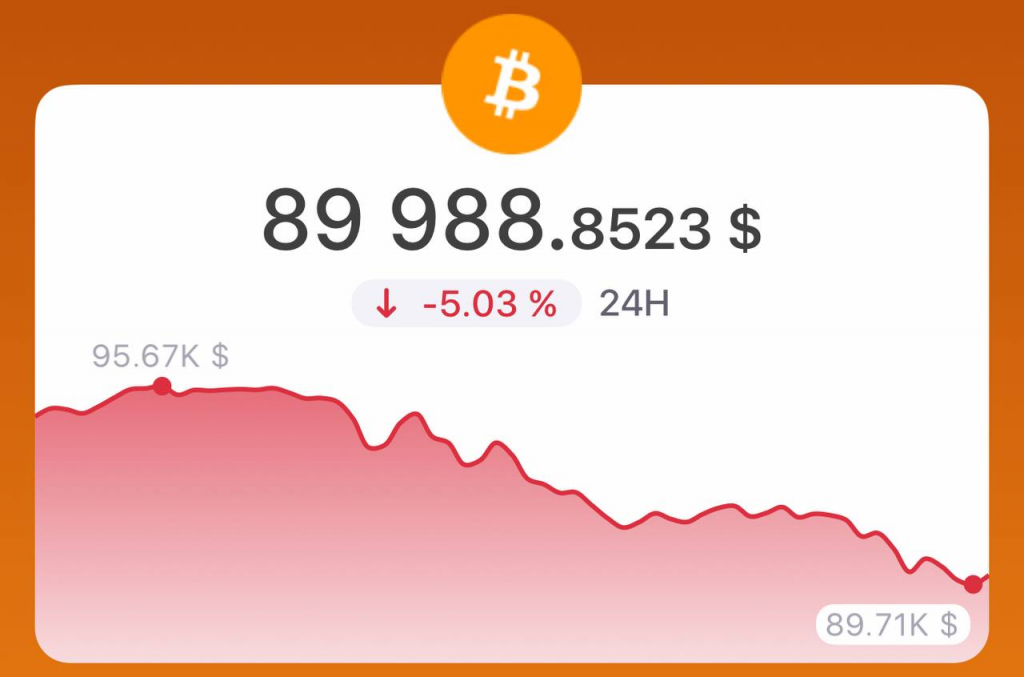

November 19, 2025 — Bitcoin plunged below the critical $90,000 threshold on Tuesday, erasing all gains made in 2025 and sending shockwaves through global cryptocurrency markets as investor sentiment deteriorated to «extreme fear» levels.

The world’s largest cryptocurrency briefly touched $89,259 before recovering slightly to trade around $91,000-$93,000, marking its lowest level since April and representing a dramatic 26-30% collapse from its October record high of $126,250 achieved just six weeks ago.

Mass Exodus from Bitcoin Markets

The sell-off has triggered a cascading effect across the entire cryptocurrency ecosystem, with major altcoins following Bitcoin’s sharp decline. Ethereum dropped 5.6%, XRP fell 3.8%, Binance Coin declined 3%, and Solana slipped 3.2% in 24-hour trading.

More alarming for market participants has been the unprecedented institutional withdrawal from Bitcoin investment products. US spot Bitcoin ETFs recorded over $2.8 billion in net outflows during November, with a single-day record of $870 million in withdrawals on November 14. Even BlackRock’s flagship IBIT ETF, typically a stabilizing force, saw $1.26 billion exit the fund this month.

Market data reveals Bitcoin has shed more than $600 billion in market value during the current downturn, with the broader cryptocurrency market losing over $1.2 trillion in the month-long rout.

Technical Breakdown Signals Deeper Trouble

The price action has triggered critical technical warning signals that historically precede extended downturns. Bitcoin broke below its 200-day moving average and formed a «death cross» — where the 50-day moving average crosses below the 200-day average — a pattern that typically coincides with multi-week drawdowns when accompanied by evaporating liquidity.

«The fall accelerated after Bitcoin failed to reclaim key support at $93,700 over the weekend,» according to market analysis from CoinDesk. The breakdown through multiple support levels has left traders facing a precarious landscape, with $829 million in long positions at risk of liquidation if prices fall below $88,000.

The Fear and Greed Index, a popular sentiment indicator, has plunged into «extreme fear» territory, reflecting the panic gripping market participants. Data shows realized losses hit $860 million on November 17, marking a second wave of panic selling that exceeded even the $820 million recorded on November 14.

Government Shutdown and Liquidity Drought

A key driver behind the market weakness has been an unexpected liquidity crisis stemming from the recent 43-day US government shutdown. Market analyst Mel Mattison noted that the federal government ran a $198 billion fiscal surplus in September, with October likely showing even greater surpluses due to the shutdown.

«We have had one of the driest periods for fiscal liquidity in months if not years,» Mattison explained. The liquidity crunch has been particularly punishing during US trading hours, when Bitcoin has consistently posted its steepest losses.

Adding to market uncertainty, Federal Reserve rate cut expectations have collapsed, with December rate cut probability falling below 50%. The combination of tightening liquidity and hawkish monetary policy expectations has created a toxic environment for risk assets.

«Crypto is closely linked to macro-economics now more than anytime in the past,» said Paul Howard, senior director at trading firm Wincent, who expects Bitcoin to remain muted near current levels through year-end.

Contagion Spreads to Stocks

The crypto crash isn’t occurring in isolation. Tech stocks have also come under severe pressure, with the Nasdaq 100 falling 4.5% in November and losing approximately $2.6 trillion in market value since its late October peak. The S&P 500 has recorded its longest daily losing streak since August, closing lower for four consecutive days.

Major technology stocks have suffered sharp declines: Nvidia fell 2.81%, Amazon dropped 4.43%, and Microsoft declined 2.7% on Tuesday alone. The correlation between crypto and equity markets has intensified, with both asset classes responding to the same macro drivers.

«Bitcoin’s pullback is part of a broader shift in risk sentiment,» said Haider Rafique, global managing partner at crypto exchange OKX.

Whale Activity and Strategic Moves

Analysis from blockchain intelligence firms reveals that large holders — wallets containing more than 1,000 Bitcoin — executed significant sales that contributed to the price collapse, dumping positions as Bitcoin fell from below $100,000 to the low $90,000 range.

However, not all major players are retreating. El Salvador made its largest single-day Bitcoin purchase, acquiring 1,090 BTC worth approximately $100 million at current prices, bringing the country’s national reserves close to 7,500 BTC. President Nayib Bukele continues his «buy the dip» strategy despite an IMF loan agreement that formally discourages new public-sector Bitcoin purchases.

Corporate Bitcoin treasuries have also come under pressure. Michael Saylor’s Strategy Inc. and similar digital asset treasuries face increased strain as token prices fall below key accumulation levels.

Adding to market nervousness, defunct exchange Mt. Gox moved approximately $956 million worth of Bitcoin to a new wallet. While the motives remain unclear, such movements historically precede distributions to creditors — representing a potential future source of additional supply that markets are monitoring closely.

Leveraged Positions Wiped Out

The volatility has been particularly brutal for leveraged traders. Bitcoin recorded $116.8 million in liquidations over 24 hours, with $95.3 million coming from long positions — traders betting on price increases. The aggressive positioning has been systematically unwound as prices declined.

Bitcoin derivatives contracts across major exchanges have fallen approximately 30% from this year’s peak as fear climbs and traders reduce risk exposure.

Expert Analysis: Bottom or Further to Fall?

Market analysts remain divided on whether Bitcoin has found a floor or faces additional downside.

Rachael Lucas, crypto analyst at BTC Markets, characterized the break below $90,000 as «a significant psychological break that underscores the market’s current fragility,» with institutional investors leading the charge through profit-taking and risk-off positioning.

Technical analysis identifies $85,000 as short-term support, with $80,000 representing a critical threshold. A break below $80,000 could drive prices toward $74,000 — last seen in February — according to analysts surveyed by DL News.

Some analysts suggest the selloff may be clearing excessive leverage from the system. Willem Schroé, CEO of bitcoin layer-2 network Botanix Labs, argued that «each cycle has these 20% to 30% pullbacks to clear leverage,» viewing the correction as a healthy market function.

Conversely, Gemini co-founder Cameron Winklevoss struck a more optimistic tone, suggesting Bitcoin’s price below $90,000 may represent «a final opportunity to buy before a potential rebound,» though this bullish view contrasts sharply with prevailing market sentiment.

Signs of Potential Stabilization

Despite the bearish pressure, some indicators suggest conditions for a relief rally may be developing:

Oversold Technical Indicators: Bitcoin’s 14-day Relative Strength Index (RSI) has fallen below 30, a level that historically precedes short-term rebounds, though the indicator alone is not definitive.

Strategic Buying: Long-term holders and institutional players like MicroStrategy continue accumulating Bitcoin during the dip. Strategy recently purchased 8,178 Bitcoin worth $835 million, demonstrating sustained conviction despite market turbulence.

Rising Short-Term Holder Activity: On-chain data shows increased activity from short-term holders, a pattern often observed near market bottoms, according to Edul Patel, CEO of crypto platform Mudrex.

What’s Next?

The Federal Reserve’s December policy decision looms as the critical catalyst that could determine Bitcoin’s near-term trajectory. Thursday’s US unemployment data release will provide crucial insights into labor market health and influence rate cut probability.

Nick Ruck, director at LVRG Research, expects continued volatility over the coming months as long-term buyers view the drop as an accumulation opportunity while trading institutions derisk amid shifting global macro factors.

Market analyst Mel Mattison offered a more optimistic longer-term outlook, suggesting that «the flood gates are about to open» as the Trump administration prepares to «unleash a tsunami of fiscal largess in coming quarters.»

Paul Howard of Wincent took the opposite view, stating, «My sense is with just six weeks left, we’ve seen the all-time highs for 2025.»

Whether this represents a temporary setback in Bitcoin’s longer-term uptrend or the beginning of a deeper bear market remains unclear. What is certain is that the cryptocurrency’s recent plunge serves as a stark reminder that despite growing institutional adoption, Bitcoin remains a highly volatile asset capable of dramatic price swings.

As OKX’s Haider Rafique noted, «How the market behaves over the next several days will signal whether this becomes a deeper reset or just a sharp, temporary dip in an otherwise intact cycle.»

Market Data (as of November 19, 2025)

- Bitcoin Price: ~$91,000-$93,000

- 24-Hour Change: -4% to -5%

- November Change: -1.12%

- Peak to Current: -26% to -30% from October high of $126,250

- Year-to-date Performance: All 2025 gains erased

Sources:

- CoinDesk: Bitcoin Crashes Under $90K

- CNN Business: Why Crypto Is Melting Down

- Bloomberg: Bitcoin drops below $90,000 analysis

- TS2 Technology: Bitcoin Price Analysis

- TradingView News: Crypto Slides Below $90,000

- DL News: What’s Behind the Plunging Price

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and speculative. Always conduct thorough research and consult with qualified financial professionals before making investment decisions.